Tally:

Moving and trying to start fresh? Trying to save money before your big move? Need help managing your money?

Let’s talk Tally.

Debt comes from three main categories of people. Some people consciously spend money they don’t have but justify the spending. Some people have accrued debt “temporarily” because of big investments like school or a car. Other people accrue debt, month after month without even really realizing it!

Money spending habits can make or break your life over time. Habits are hard to break especially when credit card companies don’t deliver the repercussions of you overspending until a month after it’s too late.

Interested in a simple way to manage your money? Tally is an app that will work great for almost anyone who needs a little help.

When you miss a payment, which is beyond easy to do, or carries a balance for a while, you are charged crazy interest rates and lose more and more money exponentially over time.

Tally allows you to pay all your credit cards with just one payment. Tally is basically like a personal assistant; as long as you pay your personal assistant, (Tally) all your credit cards will get paid, on time. Tally even guarantees you will never pay a late fee again. If you are low on funds, Tally’s Credit Line kicks in ensures you are paying the minimum on all your cards every month.

On average each person has 4 cards. Say you have a Southwest card to earn miles for flights, American Express so you can shop at Costco and a Chase Bank card. This may or may not be hard to believe but Americans stomach an average of 100 million late fees every year. That’s 2.6 billion dollars that credit card companies make off our bad habits and negligence to pay our credit card bills on time.

On average borrowers pay $1000 a year. That being said, this ninety-nine cent app might just be one of the best payoffs you could ever imagine. Come on people, let’s work smarter, not harder.

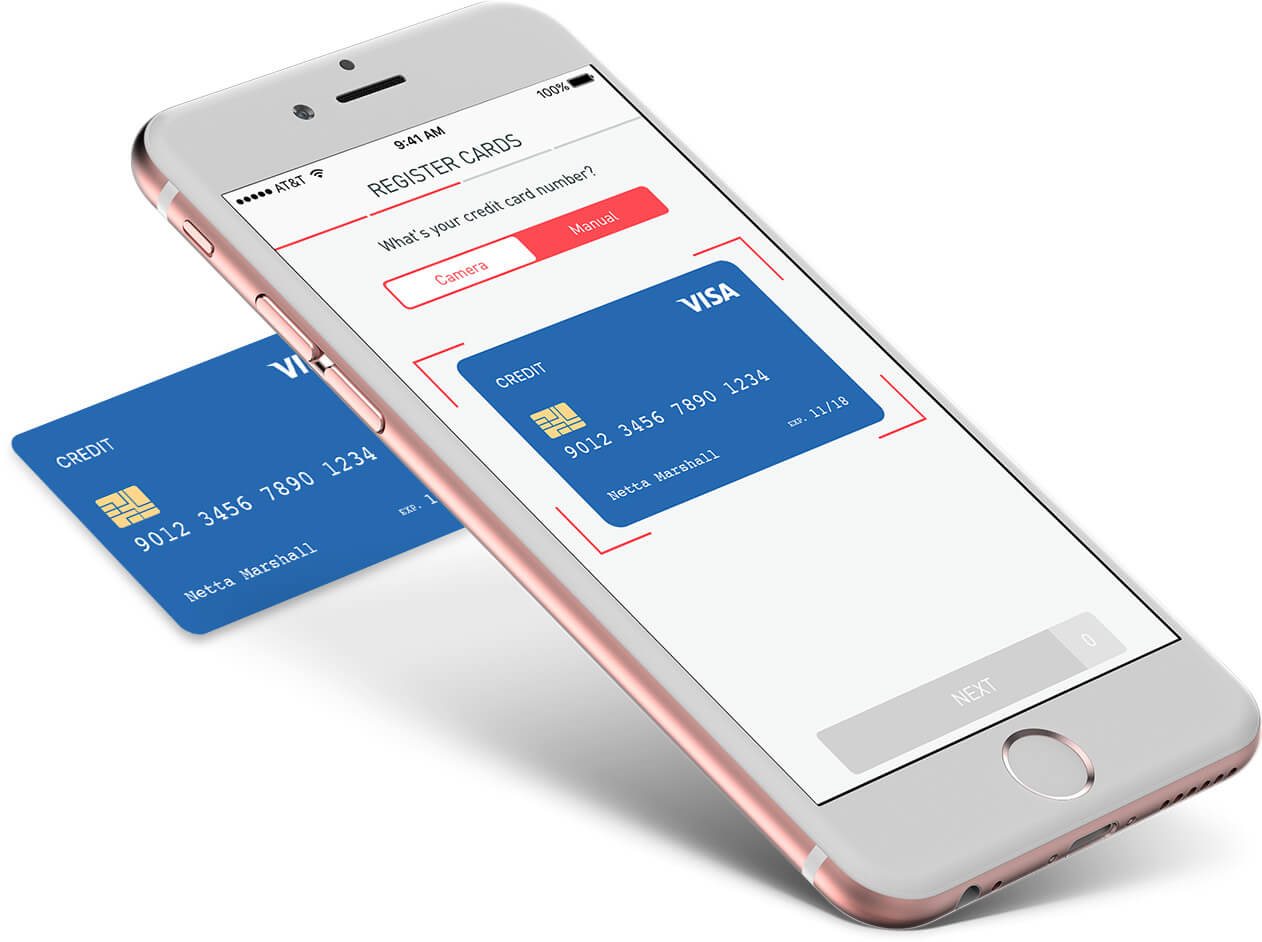

To get started you will submit each of the cards into the Tally app. The app analyzes your balances, payments, and interest rates, then runs a credit check to see if you are eligible for the service. If you are eligible Tally will give you a credit line with a low APR. Then every month Tally pays all your credit cards for you, using your new credit line. With Tally you will bypass overdraft fees; if you are low on funds, Tally’s Credit Line kicks in and ensures you are paying the minimum on all of your cards, every month. Just make sure you don’t pay your Tally payment!!

Win the same rewards and points on your chosen cards, but with lower APRs when you use Tally. If you qualify for Tally they absorb your current interest rates and substitute it with a better rate. With Tally, you risk less, but gain the same rewards. Again, just make sure you pay Tally.

The goal with Tally is to help you stay on top of your debt as you improve spending habits by saving you money on interest rates and overdraft fees.

Why Tally is worth it?

- Stay organized

- Simplify your payments

- User friendly

- Save on APR

- No overdraft fees

- Save Money

- Same rewards, no interest… * As long as you pay Tally